Value Investing Made Easy

Find top stock opportunities with daily fundamental analysis of over 2000 stocks. We assess their price appreciation or depreciation potential based on financial reports, sector performance, and growth trends.

The Approach

Value Investing

Value investing entails choosing undervalued stocks trading below their intrinsic value or target price. As value investors, we purchase stocks that the market underestimates, indicating they are undervalued, and sell them once they approach their target price.

Fundamental Analysis

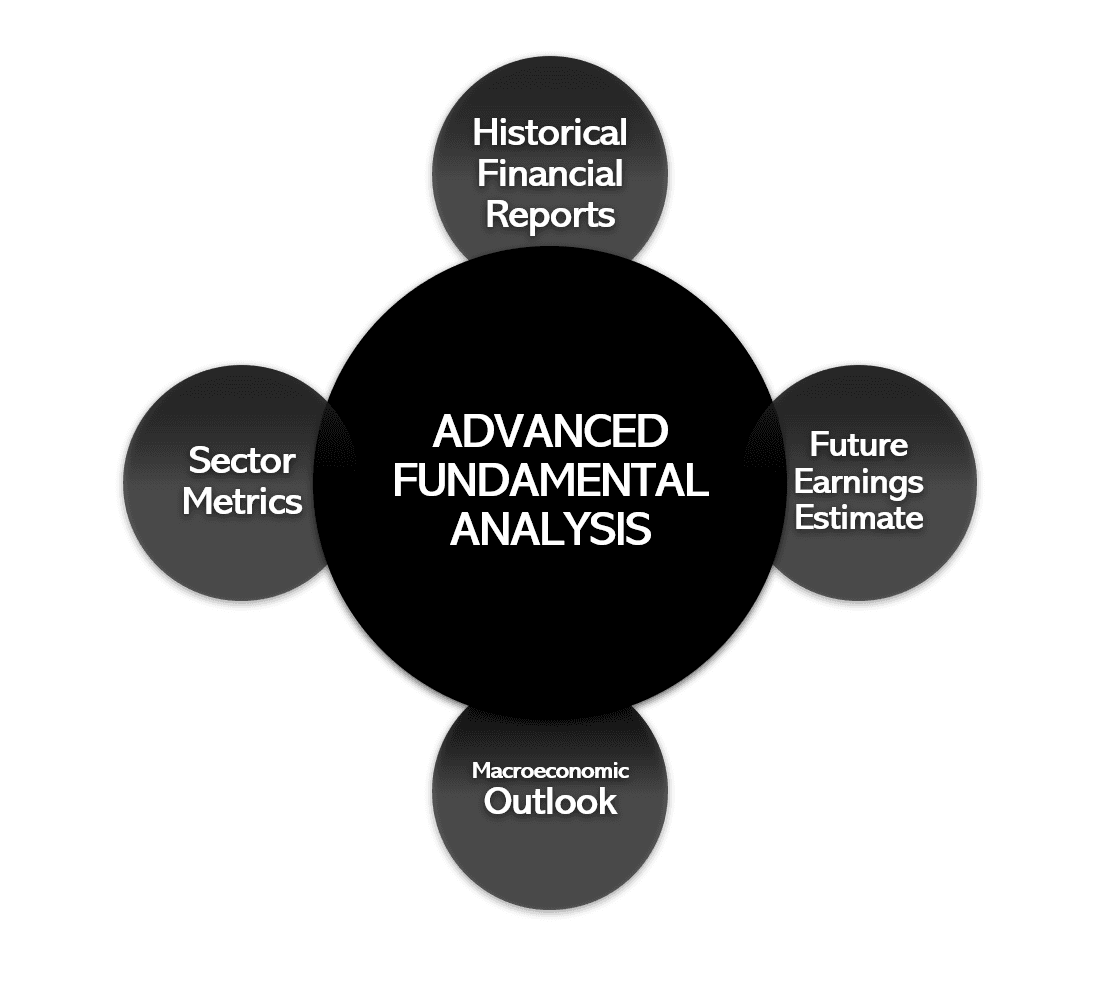

Our sophisticated stock fundamental analysis integrates historical financial reports (income statement, balance sheet, cash flow), sector-specific factors, future growth, and macroeconomic trends to determine the stock's target price.

Discover the Potential of Any Stock

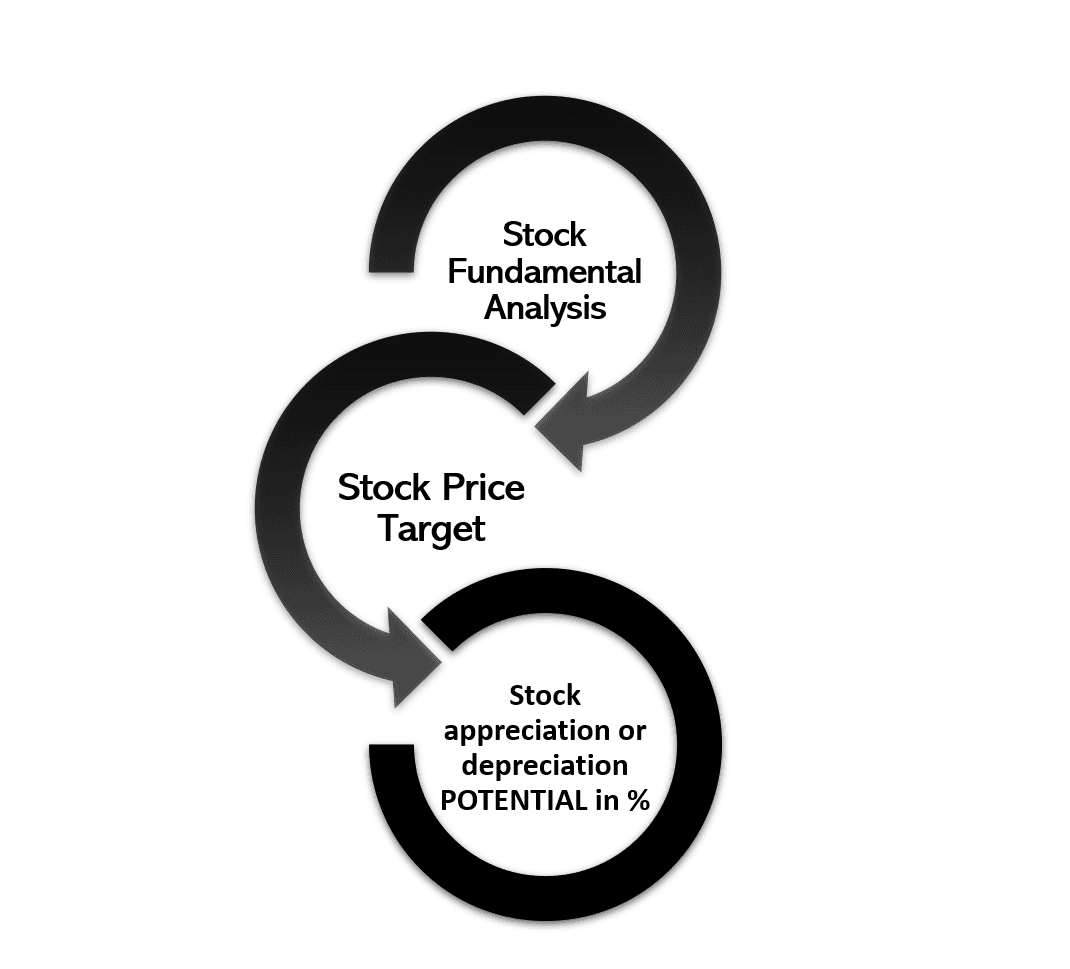

The stock's target price is calculated from advanced discounted cash flow techniques. This target price reflects the intrinsic value of the stock. The ratio between the target price and the current stock price is the appreciation (+) or depreciation (-) potential in percentage, or margin of safety.

Sector Adaptation

Companies are analyzed within their specific sectors, accounting for unique characteristics, market dynamics, and cyclicality. For example, a bank requires a different analysis than a tech company or a cyclical commodity producer.

Risk Mitigation

Through rigorous mathematical analysis of company finances, only investing in high-appreciation potential companies, and selling when they hit close to their target price, investors can mitigate permanent losses, minimizing the tradeoff between risk and reward. Like Warren Buffett says, 'First rule of investing: Don't lose money. Second rule: Don't forget the first one.

Good investment opportunities aren’t going to come along too often and won’t last too long. So you’ve got to be ready to act.

Charlie Munger

Method Overview

What is taken into account for the analysis?

How is the stock Potential calculated?

Free Features

In-depth fundamental analysis, understandable for everyone.

Easy Comparator

Compare stocks across sectors with our all-in-one scoring system, analyzing profitability, debt, earnings, and growth to deliver a clear 0-100 score. Fundamental analysis made simple and easy for everyone.

Easy ComparatorCompany Detailed Analysis

A comprehensive report that analyzes a stock’s strengths and weaknesses alongside an in-depth explanation of the company’s business model. KPIs are summarized, with and stock’s potential for appreciation or depreciation is calculated.

Company Detailed AnalysisAdvanced Comparator

Compare stocks with in-depth analysis of key performance indicators using our intuitive color coding. Instantly spot optimal metrics and detect potential risks, helping you identify the best opportunities while avoiding risky KPIs.

Advanced ComparatorFair & Simple Pricing

30-day money-back guarantee and no hidden fees.

$160.00 / year

Stock Comparator Premium Annual Plan

Helping you make smart investment decisions, so you can sleep easy at night.

- Personal portfolio management

- Target price recalculation

- Access to stockcomparator portfolio

- Priority access to on-demand stock analysis

- Email alerts when the potential of your stocks falls.

$16.00 / month

Stock Comparator Premium Monthly Plan

Helping you make smart investment decisions, so you can sleep easy at night.

- Personal portfolio management

- Target price recalculation

- Access to stockcomparator portfolio

- Priority access to on-demand stock analysis

- Email alerts when the potential of your stocks falls.